The VA mortgage software is Among the most helpful monetary tools accessible to qualified U.S. veterans, Energetic-responsibility assistance members, and a few qualifying loved ones. Administered via the U.S. Office of Veterans Affairs (VA), this software offers major pros like no down payment, aggressive curiosity fees, and no private home loan insurance policies (PMI). Underneath, we delve deep into VA financial loan eligibility, making sure you have got all the knowledge needed to take advantage of this amazing prospect.

Exactly what is a VA Financial loan?

A VA mortgage is often a home loan personal loan furnished by private lenders like banking companies and mortgage loan providers, With all the Section of Veterans Affairs guaranteeing a portion of the bank loan. This warranty enables lenders to supply favorable conditions to eligible borrowers, which includes lessen fascination charges and flexible qualification necessities.

Who is Eligible for the VA Personal loan?

Eligibility for your VA bank loan is decided from the size of company, support standing, and discharge type. The following teams are generally qualified:

one. Veterans

Veterans who definitely have done the needed Lively-obligation provider are suitable. Certain company specifications incorporate:

All through wartime: A minimum of 90 consecutive days of Energetic assistance.

During peacetime: A minimum of 181 consecutive days of active company.

Reserves and Nationwide Guard associates: 6 a long time of services Except if called to active obligation (then a similar demands as Lively-responsibility members apply).

2. Active-Duty Provider Customers

Lively-responsibility associates now serving qualify following ninety consecutive days of Energetic support.

3. Surviving Spouses

The un-remarried spouse of a company member who:

Died in the line of obligation, or

Handed away from a service-linked incapacity, might be eligible.

Furthermore, spouses of prisoners of war (POW) or Individuals lacking in motion (MIA) can qualify beneath distinct problems.

four. Users of Certain Organizations

Eligibility extends to associates of some corporations, like:

Public Health Assistance officers,

Cadets at U.S. military services academies, and

Sure U.S. governing administration staff members Performing abroad.

How to get a Certificate of Eligibility (COE)

The Certificate of Eligibility (COE) is the first step towards securing a VA personal loan. It verifies to lenders you fulfill the program's eligibility specifications. Right here’s how to acquire it:

1. Through the VA eBenefits Portal

The fastest way is to use on line by way of the VA eBenefits portal. Simply log in and Adhere to the move-by-move instructions.

2. Via a VA-Permitted Lender

Most lenders can support you with acquiring your COE during the loan software approach.

3. By Mail

You can also utilize by filling out VA Sort 26-1880 and mailing it to the regional VA Mortgage Center.

Advantages of VA Loans

The VA mortgage system delivers several Advantages which make homeownership a lot more accessible for veterans and active-duty staff:

one. No Down Payment Needed

Not like common financial loans, which frequently call for a substantial deposit, VA financial loans allow qualified borrowers to finance as much as a hundred% of the house’s value.

two. Competitive Curiosity Charges

VA financial loans usually provide lessen fascination prices as opposed to traditional mortgage solutions.

three. No Private Property finance loan Insurance policy (PMI)

Because the VA assures a part of the personal loan, borrowers aren’t required to pay PMI, saving them major regular fees.

4. Constrained Closing Expenses

The VA restrictions the amount lenders can charge in closing fees, making sure affordability.

5. Versatility in Credit score Demands

While there’s no official minimum credit score to get a VA mortgage, quite a few lenders tend to be more flexible as opposed to standard loans.

Eligibility Worries and Options

Some veterans and repair members might facial area issues when deciding their eligibility. In this article’s how to address popular problems:

one. Discharge Variety

Should you had been discharged underneath other-than-honorable conditions, your eligibility may very well be afflicted. Nevertheless, you may appeal to the VA for any discharge enhance or request an evaluation within your case.

2. Spousal Eligibility Verification

Surviving spouses have to deliver documentation including VA Form 26-1817 to confirm their eligibility.

three. COE Denials

In the event your COE request is denied, double-Examine the documentation submitted or find support from a VA-authorized lender to solve The problem.

Techniques to Submit an application for a VA Loan

Right here’s a move-by-move guide to simplify your VA loan software method:

1. Obtain Your COE

As described earlier, the COE is your evidence of eligibility and also a vital Element of the process.

two. Select a VA-Accredited Lender

Not all lenders present VA financial loans. Perform which has a lender knowledgeable in VA-backed mortgages to streamline the method.

3. Pre-Qualification

Get pre-skilled to determine how much you may borrow and set up a spending plan for your property search.

4. Obtain Your property

When pre-capable, you can begin on the lookout for houses inside of your budget. Be sure the residence satisfies VA requirements.

5. Finish the Loan Application

Post your personal loan application and supply any needed documentation on the lender.

six. VA Appraisal and Underwriting

The VA needs an appraisal to ensure the home’s benefit aligns Along with the bank loan volume. At the time authorised, underwriting is done.

seven. Closing

At closing, you’ll signal the required paperwork and officially become a homeowner.

Widespread Misconceptions About VA Financial loans

Inspite of their attractiveness, several myths surround VA loans. Right here’s the truth behind them:

1. Only Initially-Time Potential buyers Can Use VA Financial loans

False. Eligible borrowers can use VA financial loans several occasions as long as they pay off the previous personal loan or meet up with entitlement restoration standards.

2. VA Loans Are Hard to Qualify For

Fake. Although you can find precise prerequisites, the procedure is commonly a lot more flexible than common financial loans.

3. VA Financial loans Choose Extended to Close

Untrue. With expert lenders, VA loans can close as quickly as common loans.

Conclusion

Understanding VA loan eligibility is crucial for veterans, Lively-duty support members, as well as their households aiming to protected cost-effective residence funding. By leveraging this reward, you'll be able to achieve your visite here aspiration of homeownership even though savoring monetary pros unmatched by other bank loan applications.

Molly Ringwald Then & Now!

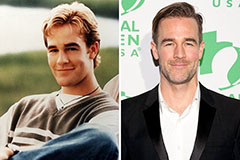

Molly Ringwald Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!